Service functions

Handling

In 2013, 1,236.8 million tonnes of freight were handled on the railway network – 2.8% less than in 2012. The average daily volume decreased by 2.5% and amounted to 3,388.5 thousand tonnes.

A decrease in handling was observed throughout 2013, with the exception of December, when the average daily handling increased by 1.8%, including an increase of 6.6% in export traffic. The negative dynamics of the average daily handling is accounted for by the trend of industrial growth stagnation that continued.

In order to minimise the negative impact of low dynamics of industrial production with regards to Russian Railways financial and economic activity indicators, the Crisis Committee resumed its work in the Company, and measures were taken to optimise costs, ensure financial stability and maintain sources of investment. Additional measures were taken with regards to cooperation with shippers. As a result, it was possible to keep the decrease in handling at a level of 2.8% and balance the financial results of the Company.

Handling volume dynamics, mln tonnes

Average daily handling dynamics in 2013, %

Handling structure by main freight types

The handling structure is comprised of stone coal, oil and oil products, construction materials, iron and black-iron ore. The combined share of the aforementioned products to total handling volume amounted to 68.1% in 2013.

Freight handling dynamics in 2013, mln tonnes

In the reporting period, the noted reduction of handling was largely due to construction and oil cargos, as well as grain and ferrous metals:

- Construction materials (-5.7% or -10.2 mln tonnes compared with 2012). The decrease in freight handling for the needs of construction enterprises in 2013 was due to the completion of major infrastructure projects in 2012-2013 (Universiade and Olympic facilities), as well as the general growth slowdown of the Russian economy.

- Oil and oil products (-3.1% or -7.9 mln tonnes compared to 2012). The main reason for the handling decrease is the reduction of crude oil transportation under the ESPO project.

- Grain (-22.4% or -4.0 mln tonnes compared to 2012). The main reason for the handling decrease is smaller harvest of grains in Russia in 2012-2013 agricultural year, as well as increased competition for suppliers in the world grain market in the second half of 2013.

- Ferrous metals (-4.5% or -3.3 mln tonnes compared to 2012). The handling decrease is mainly accounted for by low consumer demand and an oversupply of steel products in the global market.

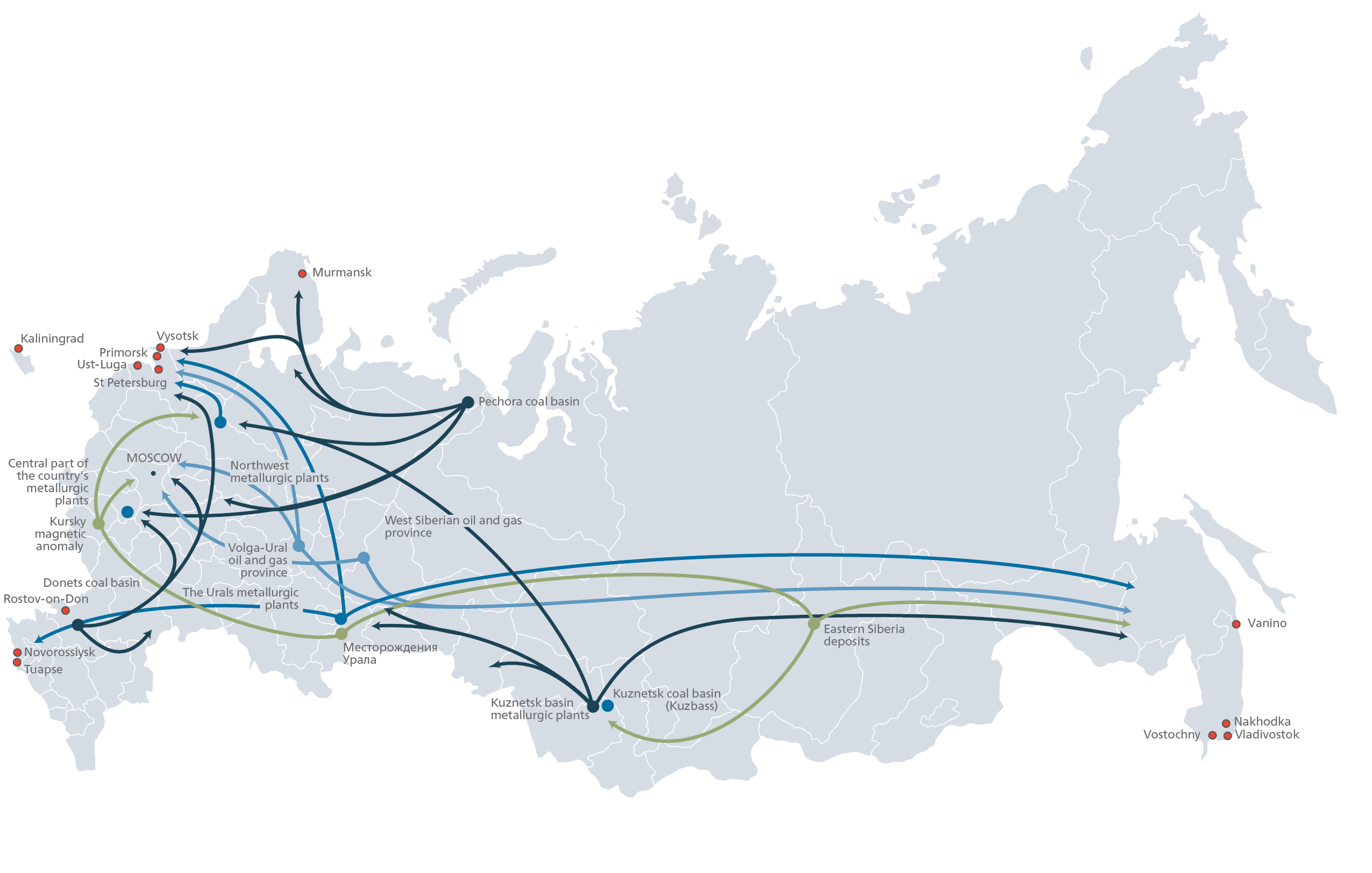

Main direction of freight flows by rail

The largest negative dynamics were shown by higher margin (-5.4%) and medium margin (-3.7%) types of freight. As a consequence, a deterioration of handling structure took place, with low-margin freight share increasing from 59.9% to 60.5%.

| High-income | Mid-income | Low-income |

- Share in total handling – 12.3% (-0.3 percentage points).

- Decrease of handling compared to 2012 (-5.4%).

In the higher margin segment, there was a decrease in handling for almost all types of freight, including the primary sources: ferrous metals (-4.5%), chemicals (-6.7%) and ferrous scrap (-7.7%). Only container freight enjoyed positive dynamics (+1.7%).

Higher margin freight handling structure, mln tonnes

- Share in total handling – 27.2% (-0.3 percentage points).

- Decrease of handling compared to 2012 (-3.7%).

The decreased handling of medium margin freight was due to a reduction of oil and oil products handling by 3.1% and grain handling by 22.4%. Growth in this segment took place only for fertilisers (+4.2%) and feed concentrates (+0.2%).

Medium margin freight handling structure, mln tonnes

- Share in total handling – 60.5% (+0.6 percentage points).

- Decrease of handling compared to 2012 (-1.8%).

During 2013, there was a decrease in the handling of construction materials (-5.7%), nonferrous ore and sulphur feedstock (-7.2%), and industrial raw materials and molding materials (-4.2%) in the low margin freight segment. At the same time, an increase in stone coal handling (+1.0%) and iron and black-iron ore (+0.7%) was achieved.

Low margin freight handling structure, mln tonnes

Handling structure by destination

In the handling structure by destination, the largest share belongs to domestic traffic - 823.9 million tonnes or 66.7%. The largest freight volumes are on Russian Railways branches lines: the West Siberian (22.1%), Sverdlovsk (10.3%) and Oktyabrskaya (8.4%) railways.

Export freight handling accounts for 32.5%. As of the end of 2013 its volume decreased by 1.9% and amounted to 402.4 million tonnes.

The handling of freight to be transported to Russian ports – accounting for almost 18% of the network handling volume – decreased by 2.6%, to 224.9 million tonnes.

The handling of freight to be transported to border crossings totalled 177.5 million tonnes in 2013, 0.6% lower than in 2012.

Freight handling structure by destination in 2013

| mln tonnes | % to 2012 | |

|---|---|---|

| Total handling | 1,236.8 | -2.8 |

| Domestic traffic | 823.9 | -3.3 |

| Export | 402.4 | -1.7 |

| Import and transit | 10.5 | -2.9 |

Export freight handling in 2013, mln tonnes

| mln tonnes | % to 2012 | |

|---|---|---|

| Total export | 402.4 | -1.7 |

| Via ports incl. | 224.9 | -2.6 |

| Via border crossings incl. | 177.5 | -0.6 |

Domestic traffic freight handling structure in 2013, mln tonnes

Export freight handling structure in 2013, mln tonnes